The Daily Leading Index decreased by 0.10% percentage points to 7.30%. The Daily Coincident Index is at 4.15%. The Daily Leading Index page on the tab above is updated daily during the week.

Equities continued to rally after being heavily oversold. Bond prices were mostly up for the week. The charts below show the normal trading ranges for various indices for the last six months. The red (or green) area indicates 2-3 standard deviations above (or below) the normal 21 day trading range. The gray area indicates 1-2 standard deviations above (or below) the normal 21 day trading range.

Earnings for the S&P 500 are strong. With 49% of the S&P 500 reporting earnings for last quarter, as reported full year earnings are on pace to be up 14.6% year over year. Next week will be a busy week for earning releases as 154 companies will report earnings.

The Leading Indicator for International Developed Markets (EFA) declined by 0.04% percentage points to 0.76%. The Leading Indicator for International Emerging Markets (EEM) fell to 4.17%. On the chart below, you can click on the blue and red buttons to see the Leading Indicator growth rate and an ETF for each country.

Sunday, October 26, 2014

Sunday, October 19, 2014

Charting Last Week (10/13- 10/17/14)

The Daily Leading Index increased by 0.23% percentage points to 7.39%. The Daily Coincident Index rose to 4.15%. The Daily Leading Index page on the tab above is updated daily during the week.

Equities rallied after . The S&P 500 (SPY) posted its largest weekly loss since May of 2012. Bond prices were mostly up for the week. The charts below show the normal trading ranges for various indices for the last six months. The red (or green) area indicates 2-3 standard deviations above (or below) the normal 21 day trading range. The gray area indicates 1-2 standard deviations above (or below) the normal 21 day trading range.

Earnings for the S&P 500 are strong. With 20% of the S&P 500 reporting earnings for last quarter, as reported full year earnings are on pace to be up 14.6% year over year. Next week will be a busy week for earning releases as 132 companies will report earnings.

The Leading Indicator for International Developed Markets (EFA) fell by .08% percentage points to 0.79% continuing its steady eight month slide. The Leading Indicator for International Emerging Markets (EEM) is at 4.20%. On the chart below, you can click on the blue and red buttons to see the Leading Indicator growth rate and an ETF for each country.

Equities rallied after . The S&P 500 (SPY) posted its largest weekly loss since May of 2012. Bond prices were mostly up for the week. The charts below show the normal trading ranges for various indices for the last six months. The red (or green) area indicates 2-3 standard deviations above (or below) the normal 21 day trading range. The gray area indicates 1-2 standard deviations above (or below) the normal 21 day trading range.

Earnings for the S&P 500 are strong. With 20% of the S&P 500 reporting earnings for last quarter, as reported full year earnings are on pace to be up 14.6% year over year. Next week will be a busy week for earning releases as 132 companies will report earnings.

The Leading Indicator for International Developed Markets (EFA) fell by .08% percentage points to 0.79% continuing its steady eight month slide. The Leading Indicator for International Emerging Markets (EEM) is at 4.20%. On the chart below, you can click on the blue and red buttons to see the Leading Indicator growth rate and an ETF for each country.

All information, data and analysis provided by this website is for informational purposes only and is not a recommendation to buy or sell any security. Click here for more details.

These charts have limitations. Economic data is often revised after the fact. The market is forward looking and anticipates future events. The unexpected can and will happen. The market is continually changing. The conditions of the past are different from the present. Past performance is not an indication of future performance.

Sunday, October 12, 2014

Charting Last Week (10/6- 10/10/14)

The Daily Leading Index increased by 0.05% percentage points to 7.16%. The Daily Coincident Index is at 3.90%. The Daily Leading Index page on the tab above is updated daily during the week.

Equities were down across the board and are in the oversold territory. The S&P 500 (SPY) posted its largest weekly loss since May of 2012. Bond prices were mostly up for the week. The charts below show the normal trading ranges for various indices for the last six months. The red (or green) area indicates 2-3 standard deviations above (or below) the normal 21 day trading range. The gray area indicates 1-2 standard deviations above (or below) the normal 21 day trading range.

The OECD released their Leading Indicators for most major countries on Wednesday. 16 of the 20 countries in the Developed Markets had declining Leading Indices. The Leading Indices declined for 8 out of 15 countries in the Emerging Markets. The Leading Indicator for International Developed Markets (EFA) is at 0.87% and is 0.78% percentage points lower than last month continuing its steady eight month slide. The Leading Indicator for International Emerging Markets (EEM) fell to 4.19%. On the chart below, you can click on the blue and red buttons to see the Leading Indicator growth rate and an ETF for each country.

Equities were down across the board and are in the oversold territory. The S&P 500 (SPY) posted its largest weekly loss since May of 2012. Bond prices were mostly up for the week. The charts below show the normal trading ranges for various indices for the last six months. The red (or green) area indicates 2-3 standard deviations above (or below) the normal 21 day trading range. The gray area indicates 1-2 standard deviations above (or below) the normal 21 day trading range.

The OECD released their Leading Indicators for most major countries on Wednesday. 16 of the 20 countries in the Developed Markets had declining Leading Indices. The Leading Indices declined for 8 out of 15 countries in the Emerging Markets. The Leading Indicator for International Developed Markets (EFA) is at 0.87% and is 0.78% percentage points lower than last month continuing its steady eight month slide. The Leading Indicator for International Emerging Markets (EEM) fell to 4.19%. On the chart below, you can click on the blue and red buttons to see the Leading Indicator growth rate and an ETF for each country.

All information, data and analysis provided by this website is for informational purposes only and is not a recommendation to buy or sell any security. Click here for more details.

These charts have limitations. Economic data is often revised after the fact. The market is forward looking and anticipates future events. The unexpected can and will happen. The market is continually changing. The conditions of the past are different from the present. Past performance is not an indication of future performance.

Thursday, October 9, 2014

International Leading Indicators - 10/8/14

The Leading Indicator for International Developed Markets (EFA) fell to 1.18% and is 1.18% percentage points lower than last month continuing its steady eight month slide. The Leading Indicator for International Emerging Markets (EEM) fell to 4.19%.

The OECD released their Leading Indicators for most major countries yesterday. 16 of the 20 countries in the Developed Markets had declining Leading Indices. The Leading Indices declined for 8 out of 15 countries in the Emerging Markets. When available, I have averaged the indicators with the Conference Board's Leading indicators to create a composite for each country. I created Leading Indicators for International Developed Markets (EFA) and International Emerging Markets (EEM) by weighting each country's growth rate by the market share of each country's stocks in the respective funds. On the last chart below, you can click on the blue and red buttons to see the Leading Indicator growth rate and an ETF for various countries.

The OECD released their Leading Indicators for most major countries yesterday. 16 of the 20 countries in the Developed Markets had declining Leading Indices. The Leading Indices declined for 8 out of 15 countries in the Emerging Markets. When available, I have averaged the indicators with the Conference Board's Leading indicators to create a composite for each country. I created Leading Indicators for International Developed Markets (EFA) and International Emerging Markets (EEM) by weighting each country's growth rate by the market share of each country's stocks in the respective funds. On the last chart below, you can click on the blue and red buttons to see the Leading Indicator growth rate and an ETF for various countries.

All information, data and analysis provided by this website is for informational purposes only and is not a recommendation to buy or sell any security. Click here for more details.

Furthermore, these charts have limitations. Economic data is often revised after the fact. The market is forward looking and anticipates future events. The unexpected can and will happen. The market is continually changing. The conditions of the past are different from the present. Past performance is not an indication of future performance.

Sunday, October 5, 2014

Charting Last Week (9/29- 10/3/14)

The Daily Leading Index decreased by 0.67% percentage points to 7.11%. The Daily Coincident Index is at 3.90%. The Daily Leading Index page on the tab above is updated daily during the week.

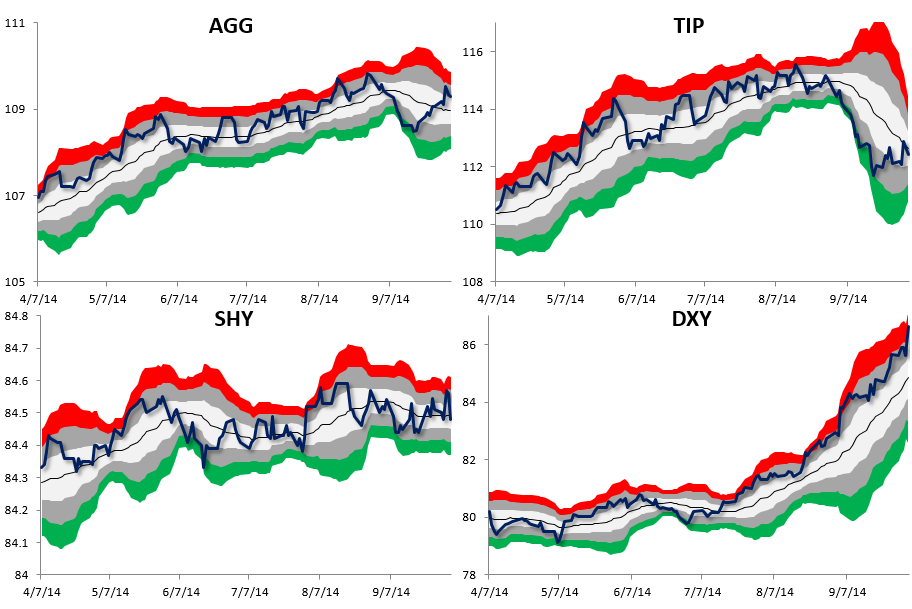

Equities were down for the week while bond prices were mostly up. The charts below show the normal trading ranges for various indices for the last six months. The red (or green) area indicates 2-3 standard deviations above (or below) the normal 21 day trading range. The gray area indicates 1-2 standard deviations above (or below) the normal 21 day trading range.

There were not any updates to the International Leading Indices during the week. The Leading Index for the International Developed Markets (EFA) is at 0.84%. The Leading Index for International Emerging Markets (EEM) is at 4.20%. On the chart below, you can click on the blue and red buttons to see the Leading Indicator growth rate and an ETF for each country.

Equities were down for the week while bond prices were mostly up. The charts below show the normal trading ranges for various indices for the last six months. The red (or green) area indicates 2-3 standard deviations above (or below) the normal 21 day trading range. The gray area indicates 1-2 standard deviations above (or below) the normal 21 day trading range.

There were not any updates to the International Leading Indices during the week. The Leading Index for the International Developed Markets (EFA) is at 0.84%. The Leading Index for International Emerging Markets (EEM) is at 4.20%. On the chart below, you can click on the blue and red buttons to see the Leading Indicator growth rate and an ETF for each country.

All information, data and analysis provided by this website is for informational purposes only and is not a recommendation to buy or sell any security. Click here for more details.

These charts have limitations. Economic data is often revised after the fact. The market is forward looking and anticipates future events. The unexpected can and will happen. The market is continually changing. The conditions of the past are different from the present. Past performance is not an indication of future performance.

Subscribe to:

Posts (Atom)