Tomorrow, the Bureau of Economic Analysis (BEA) will announce the Third Estimate of the 2017 First Quarter GDP growth rate. The average prediction in the Wall Street Journal's Economic Forecasting Survey, with 54 economists responding, is a 1.20% GDP growth rate (quarter over quarter growth at an annualized rate) with a high of 2.0% and a low of 0.8% (this is up from last month's average prediction of 0.89%). The Second Estimate of the 2017 First Quarter GDP growth rate announced on May 26 was 1.15%.

The North Star GDP Forecast for the first quarter of 2017 is at 1.99% year over year growth which comes out to 0.96% (quarter over quarter growth at an annualized rate) down from last month's Forecast of 1.32% (QoQ). The North Star GDP Estimate for the second quarter of 2017 is 1.95% year over year growth (or 1.27% QoQ).

Wednesday, June 28, 2017

Sunday, June 25, 2017

Charting Last Week (6/19 - 6/23/17)

The North Star GDP Estimate for the first quarter is 1.94% year over year growth (0.79% QoQ). The North Star GDP Forecast for the second quarter of 2017 is at 1.92% year over year growth (1.31% QoQ) unchanged from last week. The GDP Forecast page on the tab above is updated periodically during the week.

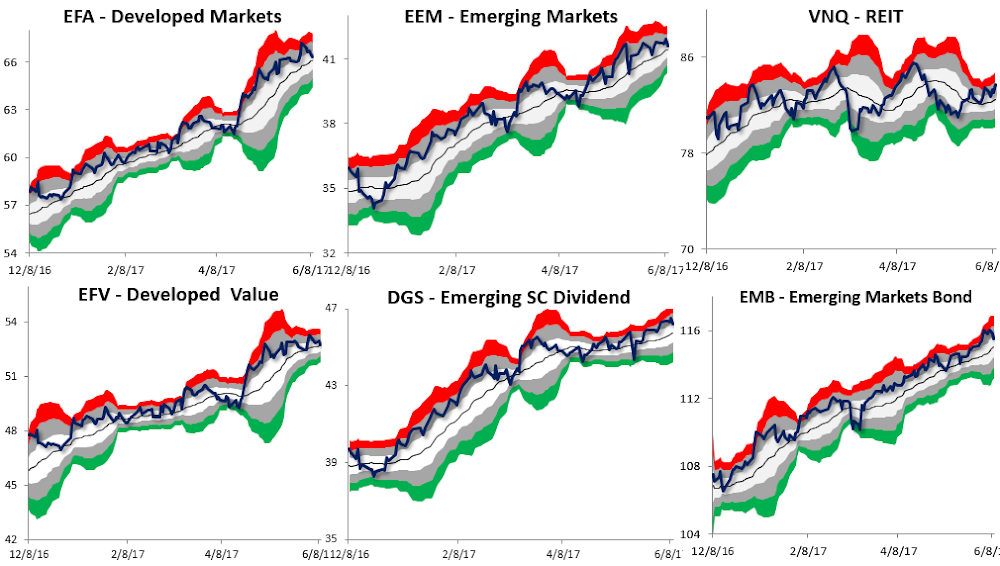

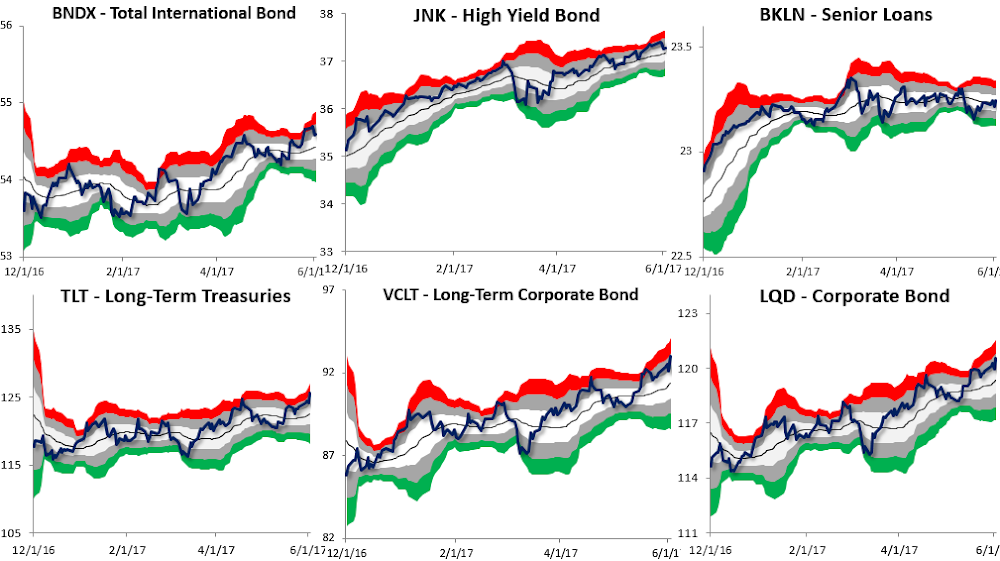

Stock prices were mixed for the week while bond prices were mostly up. The Fed Funds futures are now implying a 53.1% chance of a rate hike by December of 2017 (up from a 45.6% chance last week) according to CME Group's FedWatch tool. The charts below show the normal trading ranges for various indices for the last six months. The red (or green) area indicates 2-3 standard deviations above (or below) the normal 21 day trading range. The gray area indicates 1-2 standard deviations above (or below) the normal 21 day trading range.

The Leading Indicator for International Developed Markets (EFA) increased by 0.07% percentage points to 2.86%, the highest it has been since June 2014. The Leading Indicator for International Emerging Markets (EEM) increased to 4.63%. On the chart below, you can click on the blue and red buttons to see the Leading Indicator growth rate and an ETF for each country.

Stock prices were mixed for the week while bond prices were mostly up. The Fed Funds futures are now implying a 53.1% chance of a rate hike by December of 2017 (up from a 45.6% chance last week) according to CME Group's FedWatch tool. The charts below show the normal trading ranges for various indices for the last six months. The red (or green) area indicates 2-3 standard deviations above (or below) the normal 21 day trading range. The gray area indicates 1-2 standard deviations above (or below) the normal 21 day trading range.

The Leading Indicator for International Developed Markets (EFA) increased by 0.07% percentage points to 2.86%, the highest it has been since June 2014. The Leading Indicator for International Emerging Markets (EEM) increased to 4.63%. On the chart below, you can click on the blue and red buttons to see the Leading Indicator growth rate and an ETF for each country.

All information, data and analysis provided by this website is for informational purposes only and is not a recommendation to buy or sell any security. Click here for more details.

These charts have limitations. Economic data is often revised after the fact. The market is forward looking and anticipates future events. The unexpected can and will happen. The market is continually changing. The conditions of the past are different from the present. Past performance is not an indication of future performance.

Sunday, June 18, 2017

Charting Last Week (6/12 - 6/16/17)

The North Star GDP Estimate for the first quarter is 1.95% year over year growth (0.79% QoQ). The North Star GDP Forecast for the second quarter of 2017 is at 1.92% year over year growth (1.31% QoQ) down from last week's reading of 1.96%. The GDP Forecast page on the tab above is updated periodically during the week.

Stock prices were mixed for the week while bond prices were mostly up. As expected the Fed hiked rates by a quarter of a percent last week. The Fed Funds futures are now implying no more rate hikes in 2017 with a 52.6% chance of a rate hike by March of 2018 (down from a 60.7% chance last week) according to CME Group's FedWatch tool. The charts below show the normal trading ranges for various indices for the last six months. The red (or green) area indicates 2-3 standard deviations above (or below) the normal 21 day trading range. The gray area indicates 1-2 standard deviations above (or below) the normal 21 day trading range.

The Leading Indicator for International Developed Markets (EFA) increased by 0.03% percentage points to 2.79%, the highest it has been since June 2014.. The Leading Indicator for International Emerging Markets (EEM) decreased to 4.57%. On the chart below, you can click on the blue and red buttons to see the Leading Indicator growth rate and an ETF for each country.

Stock prices were mixed for the week while bond prices were mostly up. As expected the Fed hiked rates by a quarter of a percent last week. The Fed Funds futures are now implying no more rate hikes in 2017 with a 52.6% chance of a rate hike by March of 2018 (down from a 60.7% chance last week) according to CME Group's FedWatch tool. The charts below show the normal trading ranges for various indices for the last six months. The red (or green) area indicates 2-3 standard deviations above (or below) the normal 21 day trading range. The gray area indicates 1-2 standard deviations above (or below) the normal 21 day trading range.

The Leading Indicator for International Developed Markets (EFA) increased by 0.03% percentage points to 2.79%, the highest it has been since June 2014.. The Leading Indicator for International Emerging Markets (EEM) decreased to 4.57%. On the chart below, you can click on the blue and red buttons to see the Leading Indicator growth rate and an ETF for each country.

All information, data and analysis provided by this website is for informational purposes only and is not a recommendation to buy or sell any security. Click here for more details.

These charts have limitations. Economic data is often revised after the fact. The market is forward looking and anticipates future events. The unexpected can and will happen. The market is continually changing. The conditions of the past are different from the present. Past performance is not an indication of future performance.

Thursday, June 15, 2017

International Leading Indicators - June 2017

The Leading Indicator for International Developed Markets (EFA) is at 2.75% and is 0.11% percentage points higher than last month. The Leading Indicator for International Emerging Markets (EEM) declined to 4.61%.

The OECD released their Leading Indicators for most major countries on Monday. 12 of the 20 countries in the Developed Markets had increasing Leading Indices. The Leading Indices decreased for 10 out of 15 countries in the Emerging Markets. When available, I have averaged the indicators with the Conference Board's Leading indicators to create a composite for each country. I created Leading Indicators for International Developed Markets (EFA) and International Emerging Markets (EEM) by weighting each country's growth rate by the market share of each country's stocks in the respective funds. On the last chart below, you can click on the blue and red buttons to see the Leading Indicator growth rate and an ETF for various countries.

The OECD released their Leading Indicators for most major countries on Monday. 12 of the 20 countries in the Developed Markets had increasing Leading Indices. The Leading Indices decreased for 10 out of 15 countries in the Emerging Markets. When available, I have averaged the indicators with the Conference Board's Leading indicators to create a composite for each country. I created Leading Indicators for International Developed Markets (EFA) and International Emerging Markets (EEM) by weighting each country's growth rate by the market share of each country's stocks in the respective funds. On the last chart below, you can click on the blue and red buttons to see the Leading Indicator growth rate and an ETF for various countries.

All information, data and analysis provided by this website is for informational purposes only and is not a recommendation to buy or sell any security. Click here for more details.

Furthermore, these charts have limitations. Economic data is often revised after the fact. The market is forward looking and anticipates future events. The unexpected can and will happen. The market is continually changing. The conditions of the past are different from the present. Past performance is not an indication of future performance.

Sunday, June 11, 2017

Charting Last Week (6/5 - 6/9/17)

The North Star GDP Estimate for the first quarter is 1.95% year over year growth (0.79% QoQ). The North Star GDP Forecast for the second quarter of 2017 is at 1.96% year over year growth (1.48% QoQ) down from last week's reading of 1.99%. The GDP Forecast page on the tab above is updated periodically during the week.

Stock prices were mixed for the week while bond prices were mostly down. The Fed Funds futures are now implying two more rate hikes in 2017 with a 100.0% chance of a rate hike next week (up from a 94.6% chance last week) and the next hike after that in December according to CME Group's FedWatch tool. The charts below show the normal trading ranges for various indices for the last six months. The red (or green) area indicates 2-3 standard deviations above (or below) the normal 21 day trading range. The gray area indicates 1-2 standard deviations above (or below) the normal 21 day trading range.

The Leading Indicator for International Developed Markets (EFA) increased by 0.03% percentage points to is at 2.77%, the highest it has been since July 2014.. The Leading Indicator for International Emerging Markets (EEM) is at 4.83%. On the chart below, you can click on the blue and red buttons to see the Leading Indicator growth rate and an ETF for each country.

Stock prices were mixed for the week while bond prices were mostly down. The Fed Funds futures are now implying two more rate hikes in 2017 with a 100.0% chance of a rate hike next week (up from a 94.6% chance last week) and the next hike after that in December according to CME Group's FedWatch tool. The charts below show the normal trading ranges for various indices for the last six months. The red (or green) area indicates 2-3 standard deviations above (or below) the normal 21 day trading range. The gray area indicates 1-2 standard deviations above (or below) the normal 21 day trading range.

The Leading Indicator for International Developed Markets (EFA) increased by 0.03% percentage points to is at 2.77%, the highest it has been since July 2014.. The Leading Indicator for International Emerging Markets (EEM) is at 4.83%. On the chart below, you can click on the blue and red buttons to see the Leading Indicator growth rate and an ETF for each country.

All information, data and analysis provided by this website is for informational purposes only and is not a recommendation to buy or sell any security. Click here for more details.

These charts have limitations. Economic data is often revised after the fact. The market is forward looking and anticipates future events. The unexpected can and will happen. The market is continually changing. The conditions of the past are different from the present. Past performance is not an indication of future performance.

Sunday, June 4, 2017

Charting Last Week (5/30 - 6/2/17)

The North Star GDP Estimate for the first quarter is 1.94% year over year growth (0.77% QoQ). The North Star GDP Forecast for the second quarter of 2017 is at 1.99% year over year growth (1.61% QoQ) down from last week's reading of 2.09%. The GDP Forecast page on the tab above is updated periodically during the week.

The S&P 500 once again hit a new record high this week. The Fed Funds futures are now implying just one more rate hike in 2017 with a 94.6% chance of a rate hike this month (up from a 83.1% chance last week) and the next hike after that in January of 2018 according to CME Group's FedWatch tool. The charts below show the normal trading ranges for various indices for the last six months. The red (or green) area indicates 2-3 standard deviations above (or below) the normal 21 day trading range. The gray area indicates 1-2 standard deviations above (or below) the normal 21 day trading range.

There were not any updates to the International Leading Indices during the week. The Leading Indicator for International Developed Markets (EFA) is at 2.74%. The Leading Indicator for International Emerging Markets (EEM) is at 4.88%. On the chart below, you can click on the blue and red buttons to see the Leading Indicator growth rate and an ETF for each country.

The S&P 500 once again hit a new record high this week. The Fed Funds futures are now implying just one more rate hike in 2017 with a 94.6% chance of a rate hike this month (up from a 83.1% chance last week) and the next hike after that in January of 2018 according to CME Group's FedWatch tool. The charts below show the normal trading ranges for various indices for the last six months. The red (or green) area indicates 2-3 standard deviations above (or below) the normal 21 day trading range. The gray area indicates 1-2 standard deviations above (or below) the normal 21 day trading range.

There were not any updates to the International Leading Indices during the week. The Leading Indicator for International Developed Markets (EFA) is at 2.74%. The Leading Indicator for International Emerging Markets (EEM) is at 4.88%. On the chart below, you can click on the blue and red buttons to see the Leading Indicator growth rate and an ETF for each country.

All information, data and analysis provided by this website is for informational purposes only and is not a recommendation to buy or sell any security. Click here for more details.

These charts have limitations. Economic data is often revised after the fact. The market is forward looking and anticipates future events. The unexpected can and will happen. The market is continually changing. The conditions of the past are different from the present. Past performance is not an indication of future performance.

Subscribe to:

Posts (Atom)